|

|

In the Vietnamese market, A-segment cars no longer seem to attract much attention. Photo: Manh Quan. |

After a slight recovery in February, the sales of A-segment cars in the Vietnamese market have been declining for the past two months. In the first month of Q2, the combined sales of Hyundai Grand i10 and Kia Morning were only 618 units, a decrease of nearly 26% compared to the sales recorded in March.

Boring and Slow-Selling

With the departure of Toyota Wigo, Honda Brio, and VinFast Fadil, the A-segment car market in Vietnam is now only dominated by Hyundai Grand i10 and Kia Morning.

However, unlike the exciting sales competition in the previous decade, Kia Morning has now lost its position and is no longer on par with Hyundai Grand i10.

In the first 12 months of 2022, Kia Morning achieved sales of 3,979 units, only about one-third of the sales achieved by Hyundai Grand i10 in the same period.

Entering the new year 2023, Hyundai Grand i10 quickly caught up with sales of 2,739 units after 4 months, equivalent to a selling rate of nearly 685 units per month.

| The declining market share of the A-segment car group | ||||||

| Sales trends of the A-segment car market in Vietnam from 2022 to 2023 (Data: VAMA, TC Group) | ||||||

| Brand | Q1/2022 | Q2/2022 | Q3/2022 | Q4/2022 | 4 months of 2023 | |

| Hyundai Grand i10 | units | 3009 | 2661 | 2194 | 2888 | 2739 |

| Kia Morning | 1454 | 1645 | 479 | 401 | 603 |

Meanwhile, the sales of Kia Morning in the first 4 months of the year were only 603 units, indicating that it has not yet reached the average sales volume of its sole competitor in the segment.

At present, Hyundai Grand i10 is almost certain to become the best-selling A-segment car in the Vietnamese auto market, despite the upcoming return of Toyota Wigo to conquer Vietnamese customers.

Although still achieving good sales and being in close competition with the top 10 best-selling car groups in the market, Hyundai Grand i10 and the small and cheap car segment in general in Vietnam are facing significant pressure from neighboring segments, which have a slightly higher price but superior in terms of space, equipment, and engine.

Fading Unique Selling Points for Sales

Cheap price has long been the factor that makes the A-segment car segment the top choice for transport service professionals, young families, and first-time car buyers.

With a myriad of car choices in the market, many people will be attracted by this Unique Selling Point (USP) of the A-segment cars and quickly overlook other factors such as engine, interior space, or equipment.

However, the winning factor mentioned above of the A-segment cars is gradually being diluted due to the introduction of a series of new models and segments, which have competitive prices and many advantages compared to A-segment cars.

|

|

|

The low price is considered the top advantage of A-segment cars in the Vietnamese auto market. Photo: Vinh Phuc. |

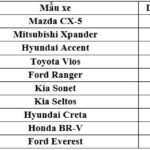

Specifically, the budget MPV group with names like Mitsubishi Xpander (555-698 million VND), Toyota Avanza Premio (558-598 million VND), or Hyundai Stargazer (575-685 million VND) only has a slightly higher starting price than the highest-spec A-segment cars by no more than 120 million VND.

If customers prefer SUV style, they can also consider Kia Sonet or Toyota Raize, which are also A-segment cars with relatively accessible prices but stand out with their high ground clearance and powerful engines.

As the price advantage is gradually diluted by the listed prices of competitors in adjacent segments, A-segment cars are losing market share in Vietnam year by year. However, the nightmare for A-segment cars seems to have just begun.

The Wave of Affordable Mini Electric Cars

In February, TMT Motors confirmed that it would assemble and distribute the Wuling Hongguang Mini EV small electric car in the Vietnamese market. In China, the Wuling Hongguang Mini EV is listed with a starting price of 4,766 USD, which means that people only have to pay less than 120 million VND to own one.

In Thailand, the Wuling Hongguang Mini EV was introduced by the Chinese automaker with a starting price of 10,674 USD, equivalent to about 250 million VND.

|

|

|

The affordable mini electric car may be the next nightmare for A-segment cars in the Vietnamese auto market. Photo: TMT Motors. |

At the moment, the selling price of the Wuling Hongguang Mini EV in Vietnam has not been officially confirmed. However, with an assumed price equivalent to the market in Thailand, Wuling’s mini electric car will become a real threat to the small remaining market share of A-segment cars.

Although not comparable to Hyundai Grand i10, Kia Morning, or soon Toyota Wigo in terms of engine power and interior space, the mini electric car will have the advantage of an attractive price. This situation is quite similar to the previous period when A-segment cars emerged as a force in the Vietnamese auto market thanks to the most accessible price despite limitations in size and many other factors.

In which, thanks to affordable prices through various preferential policies, VinFast Fadil once surpassed many familiar faces with Vietnamese consumers such as Toyota Vios, Hyundai Accent, or Ford Ranger to become the best-selling car model in the Vietnamese auto market in 2021.

Although still causing controversy, it is undeniable that VinFast Fadil had a successful year and made a big impact on the Vietnamese market in that year. Price, of course, is one of the factors that contributed to this extraordinary achievement.

In addition to the aforementioned Wuling Hongguang Mini EV, VinFast also plans to produce a small electric car model with an approximate price of 10,000-12,000 USD in the future.

|

|

|

VinFast has confirmed that it will produce a small electric car with an attractive price. Illustrative Image: Microlino. |

If this car model is realized while maintaining the same price, Vietnamese consumers will have another option of a small electric car with a price of approximately 280 million VND.

Currently, the standard manual hatchback version of Hyundai Grand i10 has a listed price of 360 million VND, the lowest in the A-segment. Compared to the estimated price of VinFast’s mini electric car, the aforementioned number is slightly higher by about 80 million VND and higher by up to 110 million VND compared to the speculated listed price of the Wuling Hongguang Mini EV in the Vietnamese market.

According to information from Reuters, BYD has publicly expressed its desire to open an electric car production plant in Vietnam, alongside another plant currently under construction in Thailand.

If this plan is implemented, there is a high possibility that the BYD Seagull will be one of the car models introduced to Vietnamese customers by the top Chinese automaker. In China, the starting listed price of the BYD Seagull is quite attractive, costing no more than 11,000 USD, equivalent to about 257 million VND.

Interesting books to read in the car

The Cars section presents readers with interesting books on various fascinating topics. During car journeys, there are moments of rest, relaxation, and books are the companions that make those times enjoyable.