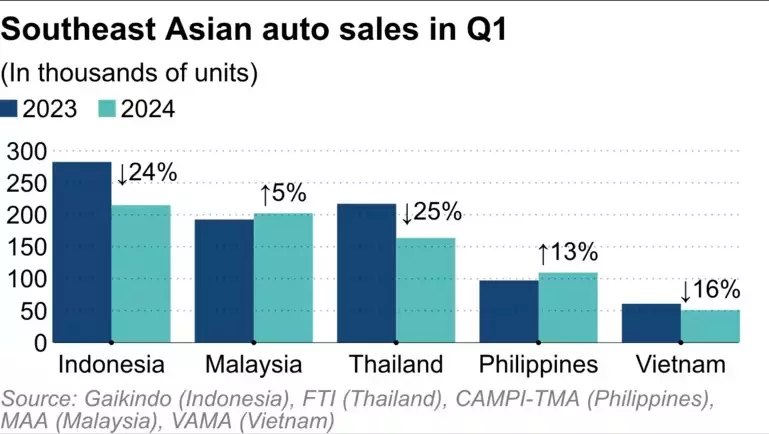

For years, Thailand has been renowned as one of the largest automotive markets in Southeast Asia. In 2023, Thailand boasted the second-highest vehicle consumption in the region, second only to Indonesia. However, this situation changed in the first quarter of 2024.

In the first three months of 2024, Malaysia surpassed Thailand to become the second-largest automotive market in Southeast Asia, after Indonesia. This shift is significant in a region that has become a crucial battleground for Asian automotive manufacturers. Previously, Malaysia had been ranked third for an extended period.

According to the Malaysia Automotive Association (MAA), car sales in Malaysia reached 202,245 units in the first quarter of 2024, a 5% increase compared to the same period last year. In 2023, the Malaysian automotive market also experienced an 11% growth, reaching a record high of 799,731 vehicles.

Malaysia surpasses Thailand to become the second-largest automotive market in Southeast Asia.

The sales tax exemption for domestically produced vehicles provided a boost to the two domestic automotive brands, Perodua and Proton, which account for approximately 60% of the market share. This policy was part of the Malaysian government’s economic stimulus package.

According to the MAA, the tax exemption began in 2020 during the pandemic and ended in mid-2022. However, the continued delivery of tax-exempt orders improved Malaysia’s automotive sales figures in 2023. “Many new models, including electric vehicles with very competitive prices, helped boost sales,” said the MMA representative.

Ivan Khoo, a sales consultant at a Toyota dealership in Kuala Lumpur, told Nikkei Asia that sales in the first two months of 2024 exceeded expectations, and the Vios model was the most popular due to its price of under 100,000 RM (approximately 21,000 USD). “I foresee both the ICE (internal combustion engine) and hybrid segments of Toyota will continue to sell well,” said Khoo.

In contrast, Thailand witnessed a decline in sales during the first quarter of this year. Known as the “Detroit of Asia” due to its focus on the automotive industry, Thailand has long held the second-highest position until a 25% year-on-year decrease in sales during the first quarter of 2024.

Thailand’s monthly vehicle sales began to drop in June last year due to inefficient auto loan schemes and stagnant overall consumption. Meanwhile, the market share of electric vehicles is on the rise with the entrance of Chinese automotive manufacturers.

The Indonesian market also lacked growth momentum in the first three months of this year. Automotive sales in Indonesia plummeted by 24% in the first quarter of 2024 compared to the previous year due to rising interest rates dampening consumer purchases.

In 2023, vehicle sales in Indonesia barely reached 1 million units, a 4% decrease from 2022 and 30,000 units short of the pre-COVID-19 level in 2019. Additionally, the market fell short of the 1.05 million units target set by the Indonesian Automotive Industry Association (Gaikindo).

Vietnam experienced a 16% decline in automotive sales during the first quarter. The economic recession caused a continuous double-digit drop in car sales in Vietnam compared to 2023. Although the demand for car purchases surged in December 2023 before the expiration of the reduced registration fee policy for domestically produced vehicles, sales figures dropped again in January and February 2024.

In contrast, the Philippines’ automotive market witnessed a 13% sales increase in the first quarter of this year, the highest among the five countries. This growth can be attributed to the inflation rate dropping to around 4% at the end of 2023 and sustained high consumer spending in the Philippines.

Performance of the top 5 automotive markets in Southeast Asia in the first quarter of 2024.

As automotive manufacturers from China, Japan, South Korea, and other countries intensify competition in Southeast Asian countries with a growing middle class, subsidies, and macroeconomic conditions are expected to be the primary drivers of regional automotive sales.

The Malaysia Automotive Association predicts a 7.5% decline in total vehicle sales in the country this year, despite anticipating increased sales of hybrid and battery-electric vehicles. “Consumer spending may slow down due to concerns over the rationalization of targeted subsidies, high living costs, the implementation of the proposed Goods and Services Tax, and higher service tax for certain services such as automotive repair and maintenance,” the association explained.