Japanese automakers are striving to maintain their presence in Indonesia by introducing their latest hybrid vehicles as an increasing number of Chinese EV brands enter the largest automotive market in Southeast Asia.

Ahead of the 2024 Gaikindo Indonesia International Auto Show (GIIAS), Toyota unveiled its newest Prius hybrid model. The event, organized by the Association of Indonesia Automotive Industries, or Gaikindo, featured 35 automotive manufacturers.

The Toyota Prius, in the Indonesian market, is offered in both conventional hybrid and plug-in hybrid variants. The vehicle will be imported from Japan, with the hybrid version priced at approximately 698 million Rupiah (1.088 billion VND).

In a press conference during the Prius launch event, Mr. Hiroyuki Ueda, head of Toyota’s automotive production in Indonesia, stated, “Hybrid technology has proven itself in the international market.”

According to Mr. Ueda, Toyota customers in Indonesia enjoy the benefits of hybrid vehicles, including lower fuel consumption, which is “very advantageous in congested traffic conditions.” The country’s capital is among the most traffic-congested cities in the world.

On the same day, Nissan also announced the introduction of its newest Serena e-Power hybrid model for the Indonesian market. Mr. Toshihiro Fujiki, President of Nissan ASEAN and Thailand, commented, “This launch demonstrates Nissan’s commitment to delivering advanced technologies.” The new model will be imported from Japan and priced at approximately 640 million Rupiah (998 million VND).

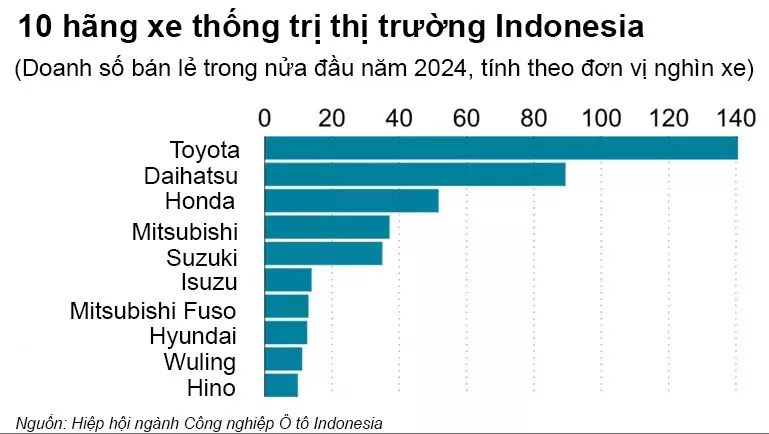

Indonesia has long been a stronghold for Japanese automakers, accounting for over 90% of the market share. In the first half of this year, Toyota, including its subsidiary Daihatsu, held over 50% of sales in the Indonesian market, followed by Honda and Mitsubishi. The largest Chinese brand in Indonesia, Wuling, ranked 9th with approximately 3% sales share.

Top 10 Brands by Sales in Indonesia for the First Half of the Year.

However, Chinese automotive manufacturers have been making efforts to penetrate this market with electric vehicles, including domestic production investments. This year, five Chinese manufacturers, including BYD and BAIC, entered the Indonesian passenger car market.

BYD showcased its latest passenger car models at the exhibition, the Atto 3 and the Dolphin, priced at 465 million Rupiah (725 million VND) and 365 million Rupiah (569 million VND), respectively. These BYD models will be imported from China to Indonesia. The company also launched the M6, an electric multi-purpose vehicle designed for the Indonesian market.

Mr. Eagle Zhao, Director of BYD Indonesia, stated, “We understand that Indonesians value strong family relationships and community activities.”

Referring to the recent inauguration of their factory in Thailand, he added, “This important milestone cements BYD’s leadership in the global new-energy vehicle market and our dedication to promoting the development of green mobility worldwide.”

To achieve its carbon neutrality goal by 2060, the Indonesian government is encouraging a shift from gas-powered vehicles to electric cars. This will also leverage the country’s abundant nickel reserves, a key component in electric vehicle batteries.

However, electric vehicles still face infrastructure challenges, particularly in charging stations. Indonesia currently has around 1,400 charging stations, far fewer than the 68,000 stations in the US. Moreover, charging stations are scarce in suburban areas.

In a survey conducted by Singapore-based research firm Milieu Insight, 47% of Indonesians cited “high price” as a reason for not purchasing an electric vehicle, while 42% pointed to the “lack of charging stations.”

Consequently, hybrid vehicles remain appealing to local consumers. According to Gaikindo’s sales data, hybrid vehicle sales in Indonesia surged 5.2 times to approximately 54,000 units in 2023. In contrast, battery-electric vehicle sales grew by nearly 70% to around 17,000 units.

Despite the push for cleaner models at the 2024 GIIAS, the Indonesian automotive industry is expected to face challenges in the coming year. While Gaikindo has set a sales target of 1.1 million vehicles for 2024, a roughly 10% increase from 2023, analysts warn of the impact of high-interest rates on auto loans.

In May 2024, Fitch Ratings commented, “Sales for the remainder of 2024 are unlikely to accelerate significantly due to the interest rate hike in April, and auto loan rates are expected to remain elevated this year as market liquidity tightens.” The company noted that approximately 80% of Indonesian consumers utilize financing packages when purchasing automobiles. Fitch forecasts annual auto sales in Indonesia to drop to around 900,000 units this year.

![[Quick Review] Hyundai IONIQ 5 – A Vehicle from the Future](https://vnauto.net/wp-content/uploads/2023/10/xehay-hyundaiioniq5-18052022-2-150x150.jpg)