|

The latest report from the Vietnam Automobile Manufacturers’ Association (VAMA) shows that in June, the total consumption of all types of automobiles in the Vietnamese market reached 26,575 units, a 3% increase compared to the previous period.

Among these, passenger cars still accounted for the majority with 19,944 units sold, while commercial and specialized vehicles accounted for 6,419 and 212 units, respectively.

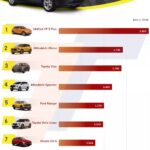

Ford Ranger Tops the Chart, Mazda CX-5 Surprises

In June, Ford Ranger recorded 1,442 units sold in the Vietnamese market. Despite a slight decrease compared to the sales performance in May, this consumption volume still helped the “pickup truck king” become the best-selling model in the entire Vietnamese market in the last month of the second quarter.

Surprisingly, the second position in the list of best-selling models in the market in June was not held by the familiar Mitsubishi Xpander. Instead, with 1,259 units sold, the Mazda CX-5 became the second-highest-selling model in Vietnam. This was also the first time since the beginning of the year that this C-sized SUV from Mazda made it into the top 3 most favored models by Vietnamese customers.

| Mazda CX-5 Enters the Top 2 Best-Sellers for the First Time | |||||||||||

| Sales of the top 10 best-selling models in the Vietnamese market in June (Data: VAMA, TC Motor) | |||||||||||

| Label | Ford Ranger | Mazda CX-5 | Mitsubishi Xpander | Hyundai Accent | Mitsubishi Xforce | Ford Everest | Toyota Yaris Cross | Toyota Vios | Ford Territory | Hyundai Creta | |

| car | 1442 | 1259 | 1236 | 968 | 948 | 830 | 811 | 769 | 748 | 686 |

On the other hand, Mitsubishi Xpander’s sales decreased by 530 units compared to May, causing it to fall out of the top 2 positions in terms of consumption in the Vietnamese automobile market.

However, with 1,236 units sold in the previous month, Mitsubishi’s small MPV model still maintained, along with Ford Ranger, as one of the few models that could sustain sales of over 1,000 units per month for four consecutive months.

Hyundai Accent slightly increased its sales to 986 units, retaining its position in the top 5 best-selling cars in the market. Meanwhile, Mitsubishi Xforce grew by 146 units compared to May’s sales, achieving a consumption volume of 948 units and completing the list of the 5 most favored models in the Vietnamese car market in the last month of the second quarter.

The remaining models in the list with the best sales performance in the Vietnamese market included Ford Everest (830 units), Toyota Yaris Cross (811 units), Toyota Vios (769 units), Ford Territory (748 units), and Hyundai Creta with a total of 686 units sold in June.

Shaping a Two-Horse Race

After the first two quarters of the year, Ford Ranger and Mitsubishi Xpander are creating an attractive two-horse race in the Vietnamese automobile market.

Before the June sales data was released, Mitsubishi Xpander and Ford Ranger were the familiar names in the top 2 positions in terms of vehicle sales to Vietnamese customers. These two models also frequently competed neck and neck in terms of cumulative sales each month, continuing throughout the first half of 2024.

Thanks to this, the gap in total consumption between Mitsubishi Xpander and Ford Ranger as of mid-2024 was only 30 units. Specifically, the “sales king” of the Vietnamese car market temporarily led with 7,773 units sold after 6 months, while the “pickup truck king” recorded 7,743 units sold as of the end of the second quarter.

| Mitsubishi Xpander and Ford Ranger in a Two-Horse Race in the Vietnamese Market | |||||||

| Cumulative sales of Mitsubishi Xpander and Ford Ranger each month (Data: VAMA) | |||||||

| Label | January | February | March | April | May | June | |

| Mitsubishi Xpander | car | 1285 | 1926 | 3508 | 4771 | 6537 | 7773 |

| Ford Ranger | 1143 | 2023 | 3562 | 4824 | 6301 | 7743 |

Despite strong growth in the last month of the second quarter, Mazda CX-5’s total sales in the Vietnamese market at this point are still at 5,270 units. The sales gap of nearly 2,500 units between Mazda CX-5 and Ford Ranger is almost insurmountable, especially when both Ranger and Xpander have consistently demonstrated their ability to maintain stable sales at high levels for several consecutive months.

In general, the efforts to become the leader in consumption in the Vietnamese automobile market will likely be a two-horse race between Ford Ranger and Mitsubishi Xpander. The small MPV model from Mitsubishi still has a chance to defend its sales crown, while the “pickup truck king” seems ready to compete for the position of “new king” of the Vietnamese car market.

Many Cars Discontinued, Zero Sales

Although sales were not really favorable, the Vietnamese car market in the first half of 2024 was still considered vibrant due to the presence of many new models, a series of updates of existing models in the market, or the first participation of several brands.

In addition, a few familiar models in the Vietnamese car market had to bid farewell, mainly due to low competitiveness in their respective segments.

In the first six months alone, the Vietnamese car market had to say goodbye to the Mazda BT-50, Suzuki Ciaz, and Toyota Yaris. In many reports this year, these models had zero sales, causing the cumulative sales from the beginning of the year to not exceed 10 units.

|

Mazda BT-50 has been removed from the Mazda brand’s product range in the Vietnamese market. Photo: Mazda. |

In addition to models that were temporarily discontinued due to poor business results, the Vietnamese car market also recorded low sales from a few quite “unique” models in terms of segment and price, such as the Toyota Land Cruiser Prado (zero sales since the beginning of the year), Toyota Alphard (56 units sold in the first 6 months), or “recreational” models including Honda Civic Type R (7 units) and Suzuki Jimny with 158 units sold after 4 months of launch.

In general, the Vietnamese car market had a relatively successful first half of the year, as despite fluctuating sales, the total automobile consumption after 6 months was only about 1.8% lower than the sales performance in the same period last year, equivalent to a difference of about 2,443 units.

The second half of 2024 is expected to be an exciting period for the Vietnamese car market with the arrival of many new car brands, mainly from the country with a population of billions.

In addition to the fee promotion program for assembled cars expected to be deployed from August, the Vietnam Motor Show (VMS) officially returning in October could also boost the recovery of the Vietnamese car market.

Recommended Books for Your Car Journey

The “Xe” column brings readers interesting book titles on various topics. During your journeys with your cars, there are moments of relaxation and these books can be your delightful companions.

Vietnam Motor Show 2022

Zing updates the event from the opening ceremony, car model images, analysis and evaluations by industry experts, and a series of podcasts produced inside the exhibition.

Honda Civic Type R Price Increase

14:08 30/8/2024

14:08

30/8/2024

0

The price of the Honda Civic Type R has increased by nearly $3,000 compared to the price announced in 2023.

Difficult Position of Chinese Car Brand GAC in Vietnam

18:08 22/8/2024

18:08

22/8/2024

0

Launching products in a “hard-to-sell” segment with uncompetitive prices, the Chinese car brand GAC seems to be putting itself in a difficult position.

Upcoming Cars in the Vietnamese Market

06:59 21/5/2024

06:59

21/5/2024

0

Cars in the A-segment, pickup trucks, and electric vehicles are among the newcomers to the Vietnamese market in the near future.

Vietnam Auto Show Returns in October with a Newcomer

16:59 9/5/2024

16:59

9/5/2024

0

Vietnam Motor Show – Vietnam Motor Show announces the time and venue after a one-year absence.

Observations from the World’s Largest Auto Show This Year

15:45 26/4/2024

15:45

26/4/2024

0

Beijing Auto Show 2024 is considered one of the world’s largest auto shows this year, reflecting the changes in the global automotive industry.

The Top 10 Best-Selling Cars in Vietnam for July 2024: VinFast VF 5 Plus Takes the Lead

VinFast has revealed an unexpected surge in sales for the VF 5 Plus in July, outperforming the Mitsubishi Xforce and shaking up the top 10 best-selling cars in Vietnam. This announcement has certainly stirred up the automotive industry, and we’re here to dive into the details and explore the implications of this news.