There have been recent discussions on social media regarding the implications of late payments for traffic-related administrative violations, with potential additional interest charges.

In fact, this regulation has been in effect since May 5, 2023, as stipulated in Circular No. 18/2023/TT-BTC issued by the Ministry of Finance.

Specifically, according to Clause 1, Article 5 of Circular No. 18/2023/TT-BTC, individuals or organizations who fail to pay fines by the stipulated deadline will be subject to enforcement and additional interest on late payments. The interest rate is set at 0.05% of the total unpaid fine amount for each day of delay.

The number of days of delay is calculated from the day following the last day of the payment deadline until the day before the individual or organization makes the payment to the state budget. It’s important to note that the calculation of interest includes both holidays and weekends.

Circular 18/2023/TT-BTC also clearly states that there are certain cases where late payment interest for administrative violations will not be applied. These include: During the period of postponement of the enforcement of the administrative violation decision; During the consideration and decision to reduce, waive the remaining amount, or allow payment of the fine in installments.

The method for determining the duration for calculating late payment interest is as follows:

If the violation decision is delivered directly, the day of late payment calculation starts 10 days (including holidays and weekends) after the deadline for enforcement stated in the violation decision, or from the date of receiving the violation decision.

If the violation decision is sent by registered mail, the day of late payment calculation starts 10 days (including holidays and weekends) after the deadline for enforcement stated in the administrative violation decision, or from the date of valid delivery of the violation decision.

In cases where individuals or organizations subject to fines do not have confirmation of the date of receipt of the violation decision and cannot present the date, but it is not intentional, the day of late payment calculation will start 12 days (including holidays and weekends) after the date of issuance of the violation decision, provided that the decision states a 10-day deadline from the date of issuance.

For those who deliberately refuse to receive the violation decision, the competent authority will take action in accordance with Article 70 of the Law on Handling Administrative Violations. The State Treasury will be notified for the calculation of late payment interest.

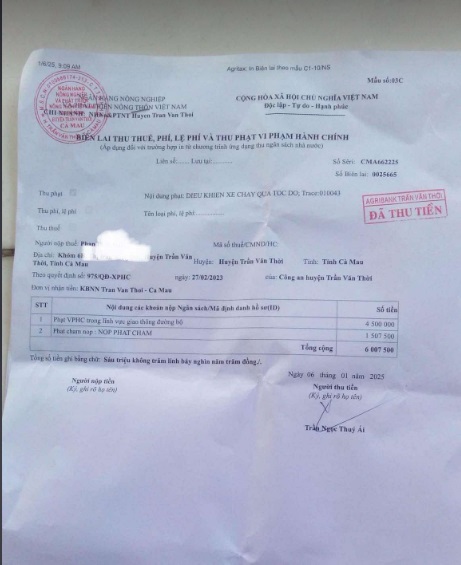

If there is a continued deliberate refusal to pay, late payment interest will continue to accrue and will be indicated on the receipt of fine payment.

TH (Tuoitrethudo)