There has been information circulating on social media regarding penalties for late payment of administrative fines for traffic order and safety violations, suggesting that interest may be incurred.

In fact, this regulation has been issued and enforced since May 5, 2023, according to Circular No. 18/2023/TT-BTC of the Ministry of Finance.

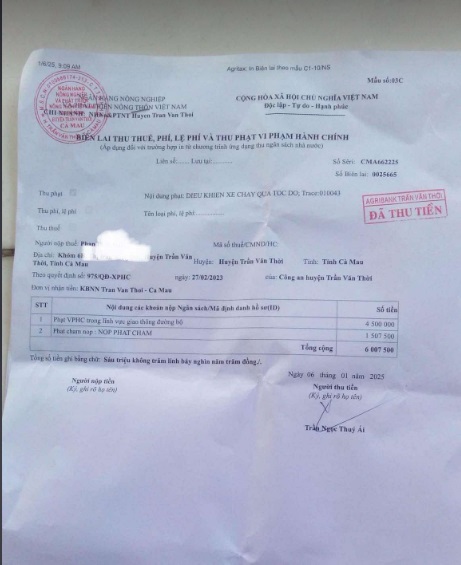

Specifically, according to Clause 1, Article 5 of Circular No. 18/2023/TT-BTC, if the deadline for executing the penalty decision passes and the individual or organization has not paid the fine, they will be subject to enforcement and additional interest for late payment. The interest rate is set at 0.05% of the total unpaid fine amount for each day of delay.

The number of days of delay is calculated from the day following the last day of the deadline for payment of the fine to the day before the individual or organization pays the money into the state budget. Note that the time for calculating interest includes holidays and weekends.

Circular 18/2023/TT-BTC also states that there are certain cases where late payment interest for administrative fines will not be applied. These include: During the period of postponement of enforcement of the administrative penalty decision; During the consideration and decision on reduction, exemption of the remaining amount, or permission to pay the fine in installments.

The method for determining the time period for calculating late payment interest is as follows:

If the penalty decision is delivered directly, the day of late payment interest calculation starts 10 days (including holidays and weekends) or after the deadline for execution stated in the penalty decision, from the date of receipt of the penalty decision.

If the penalty decision is sent by registered mail, the day of late payment interest calculation starts 10 days (including holidays and weekends) or after the deadline for execution stated in the administrative penalty decision, from the date of valid delivery of the penalty decision.

In cases where the penalized individual or organization does not have confirmation of the date of receipt of the penalty decision or cannot present the date of the penalty decision, but does not intentionally refuse to receive the penalty decision, the day of late payment calculation starts 12 days (including holidays and weekends) after the date of issuance of the penalty decision, where the penalty decision states a deadline of 10 days from the date of issuance.

For those who intentionally refuse to receive the penalty decision, the competent authority shall proceed in accordance with Article 70 of the Law on Handling of Administrative Violations. The State Treasury will be notified to calculate the late payment interest.

If there is a continued intentional refusal to pay, late payment interest will continue to be calculated and clearly stated on the receipt of fine payment.