The European Union (EU) is considering classifying carbon fiber – a favored material in the automotive and aerospace industries – as a hazardous substance. This proposal has sparked a wave of strong reactions from manufacturers, particularly in Asia.

According to Nikkei Asia, the European Parliament has drafted amendments to the End-of-Life Vehicles (ELV) Regulation, which would include carbon fiber in the restricted materials group. If adopted, the new regulation will come into force in 2029, requiring European car manufacturers to gradually eliminate this material from their production lines.

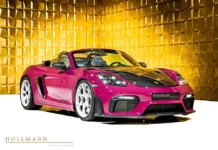

Carbon fiber has long been favored by sports car, supercar, and electric vehicle manufacturers due to its lightweight yet super-rigid properties, helping to reduce vehicle weight, improve performance, and save energy. Brands such as BMW, Hyundai, Lucid, and Tesla all extensively use this material in their electric vehicle designs.

However, the EU is concerned that carbon fibers can disperse in the air as microfibers, posing a health risk to humans if they come into direct contact with skin or are inhaled. This is the first time a government organization has proposed classifying carbon fiber as a hazardous material, equivalent to substances like lead, cadmium, mercury, and hexavalent chromium, which are already tightly controlled in industries.

Currently, the global automotive industry consumes about 20% of the carbon fiber production. Therefore, tightening regulations in the European market – one of the world’s largest automotive manufacturing centers – could have a ripple effect on many businesses in the global supply chain.

Especially, Asian carbon fiber manufacturers like Teijin, Toray Industries, and Mitsubishi Chemical, who hold 54% of the global market share, would be severely impacted if the regulation is passed. Immediately after the draft information was released, the stock prices of these companies took a significant dip.

Meanwhile, supercar and sports car manufacturers, who rely almost entirely on carbon fiber to optimize performance, are expected to be the most affected. Not only the automotive industry but also the aerospace industry will be impacted, as carbon fiber is a key material in modern aircraft manufacturing.

Industry experts believe that the EU’s new regulation aims to protect the environment and human health, but it also faces opposition from related industries. With the global carbon fiber market size expected to reach approximately USD 5.5 billion by 2024, many companies are preparing to lobby to delay or adjust the draft’s content.

In the coming time, automotive and material manufacturers will need to explore alternative solutions to maintain product performance while complying with legal requirements. However, finding a substitute material with equivalent characteristics to carbon fiber will pose significant technical and cost challenges.

TH (Tuoitrethudo)