The shift to electric vehicles is not just a change in mode of transport, but also a large-scale infrastructure challenge. As the number of electric vehicles soars year after year, the question arises: Is Vietnam’s charging infrastructure ready to keep up?

Electric Vehicle Boom and Infrastructure Pressure

The strong entry of affordable electric vehicle models such as the VinFast VF e34, VF 5, and VF 6 has injected new life into Vietnam’s automotive market. However, this green wave also poses significant challenges for charging stations, considered the lifeblood of the EV industry.

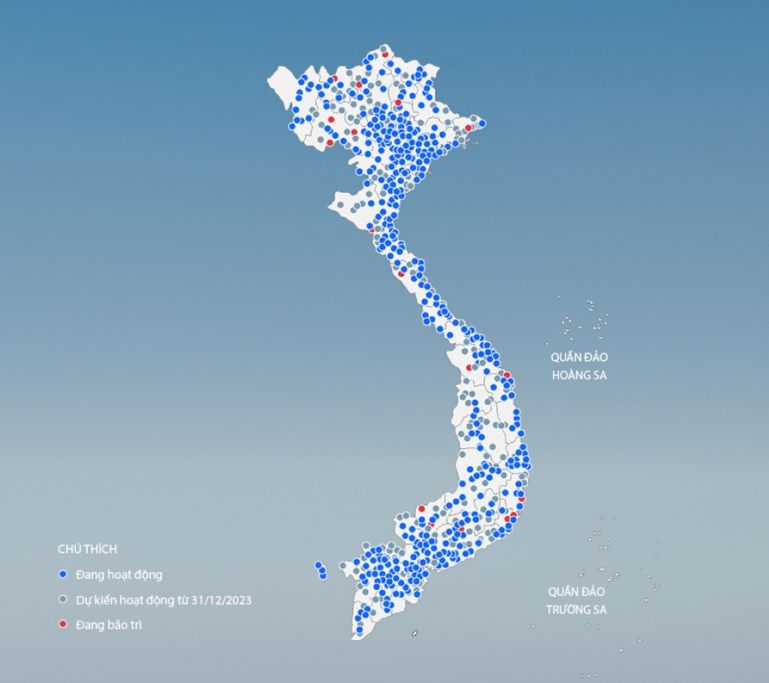

As of 2025, the country boasts over 150,000 charging ports, an impressive figure compared to its regional peers. However, the distribution remains uneven, with most ports concentrated in major urban areas or along national highways, while mountainous and rural regions lack this infrastructure.

The Big Players Take the Lead

VinFast & V-Green – Pioneer Developers

Undoubtedly, VinFast is the pioneer in developing Vietnam’s electric vehicle infrastructure. The company has deployed over 150,000 charging ports nationwide, especially in 63 provinces and along 125 national highways and expressways.

Since 2024, this network has been transferred to its subsidiary, V-Green, aiming to become Vietnam’s “EVGO,” specializing in professional and independent charging network operations and expansion.

EVN, PV Power, and the Entry of Energy Giants

Not to be outdone, energy companies like EVN and PV Power are also stepping up their game. PV Power plans to build 1,000 charging stations by 2035, while EVN explores new business models within the EV ecosystem, gearing up for the influx of foreign electric vehicle brands.

Geographical Distribution: Wide but Uneven

The charging stations are most concentrated in Hanoi, Ho Chi Minh City, Danang, and Hai Phong, the country’s economic powerhouses with high mobility demands. These stations are primarily installed in apartment building parking lots, shopping malls, gas stations, and office buildings.

On the North-South expressways, the average density of charging stations is about 50-70 km/station, sufficient for most electric vehicles today. However, areas far from these centers, like the Northwest, Central Highlands, and the remote Mekong Delta, lack charging options, especially for vehicles outside the VinFast ecosystem.

Operational Reality: Inconsistent Quality

Technologically, VinFast’s fast-charging stations (DC) offer 60kW to 250kW of power, enabling a 70-80% charge in just 30 minutes. Additionally, a comprehensive digital platform enhances user experience, allowing for station location searches, scheduling, and smartphone app-based payments.

However, operational challenges persist. Some stations experience frequent overload during peak hours, affecting continuous service. Many charging points lack periodic maintenance, resulting in technical issues like interrupted connections or vehicle incompatibilities.

Notably, the lack of standardized charging ports across brands remains a significant hurdle. With an increasing number of electric vehicles from China, South Korea, and Europe entering the market, the absence of a unified standard creates a significant barrier to compatibility between vehicles and charging infrastructure – a necessity for an efficient and convenient EV ecosystem.

Barriers to Overcome

Investment cost is a significant challenge, with each fast-charging station costing up to billions of VND. Moreover, power infrastructure in many localities is inadequate to meet the high-power demands of these stations.

Additionally, investment support policies for charging stations remain unclear, lacking attractive incentives to draw businesses. The absence of national technical standards for charging stations further complicates expansion efforts.

Charting a Course for the Future

To foster the synchronized development of the charging station ecosystem with the growth of electric vehicles, experts advocate for the swift implementation of foundational support policies.

Firstly, investment socialization should take center stage, encouraging enterprises outside the energy sector, such as real estate, retail, and logistics, to join the charging station value chain. This multi-sectoral approach will not only accelerate infrastructure expansion but also facilitate the integration of charging stations into existing convenient spaces like shopping malls, residential areas, and office parking lots.

In parallel, experts urge the government to consider exempting or reducing land and import taxes on charging equipment to alleviate initial cost pressures, especially for fast-charging stations that require substantial investments and stringent technical specifications.

Another critical bottleneck is the lack of technical standards. Establishing a national charging standard is imperative to ensure compatibility between various electric vehicle brands and charging station operators. This will not only enhance user experience but also promote the sustainable, transparent, and interconnected development of Vietnam’s EV market.

Charging Stations: The Lifeline of Vietnam’s EV Market

The sustainable growth of Vietnam’s electric vehicle industry heavily relies on the quality and coverage of its charging infrastructure. If bottlenecks in distribution, power capacity, and standardization are not addressed promptly, the EV market may stall after its initial rapid growth.

The Rise of China’s Automotive Industry: Unlocking Global Dominance

Over the decades, Beijing has strategically transformed China into the world’s largest automotive manufacturer and exporter. This remarkable feat was achieved through a carefully crafted industrial strategy that involved a delicate balance of protectionism, technological innovation, and permissive planning overshoots.

3 Reasons Why the VinFast EC Van is Creating a Stir in the Market

“The EC Van from VinFast is an impressive small cargo vehicle that offers exceptional value for money. With its superior performance, the EC Van provides a seamless driving experience, ensuring you can confidently transport your goods with ease. As emissions regulations evolve, this van is the perfect choice for those seeking a cost-effective, convenient, and compliant solution.”