Nissan and Honda have recently signed a Memorandum of Understanding (MOU) to negotiate and consider a business integration between the two companies through the establishment of a joint-stock company.

To accelerate efforts toward a carbon-neutral and accident-free society, Nissan and Honda signed an MOU on March 15 to form a strategic partnership in the era of artificial intelligence and electrification. Since then, both companies have engaged in discussions to promote collaboration in various fields.

On August 1, the two companies further signed an MOU to deepen their strategic cooperation framework. Simultaneously, they announced an agreement to conduct joint research on fundamental technologies for next-generation “software-defined vehicles” (SDVs), particularly in the critical areas of intelligence and electrification, to facilitate more focused discussions toward more concrete cooperation.

Throughout this process, Nissan and Honda have considered various possibilities and options. At the same time, the business environment of both companies and the broader automotive industry is rapidly changing, with an ever-increasing pace of technological innovation. This MOU is expected to be a choice to maintain global competitiveness while enabling the companies to continue delivering more attractive products and services to customers worldwide.

If the business integration is realized, both companies can integrate management resources, including knowledge, personnel, and technology; create deeper synergies; increase adaptability to market fluctuations; and anticipate improving enterprise value in the medium to long term. Additionally, Nissan and Honda can further contribute to the development of Japan’s industrial foundation, becoming a “global leader in mobility” by integrating Nissan’s and Honda’s four-wheeled automotive businesses, along with Honda’s motorcycle and energy products, enhancing brand appeal and delivering more innovative and attractive products and services to global customers.

Makoto Uchida, Director, President, and CEO of Nissan, stated, “Today marks an important milestone as we begin discussions on a business integration, which has the potential to shape our future. If realized, I believe combining the strengths of both companies will create unprecedented value for customers worldwide, who value our brands. Together, we can create a unique approach that no company can achieve alone.”

Toshihiro Mibe, Director, President, and CEO of Honda, shared, “Creating new mobility value by combining our resources, including the knowledge, talent, and technology that Honda and Nissan have cultivated over the years, is necessary to overcome the significant challenges facing the automotive industry. Honda and Nissan have distinct strengths. Currently, Honda has just started evaluating and has not decided on the business integration, but to find a common direction by the end of January 2025, Honda is committed to becoming a leader, creating new mobility value through the fusion of our teams.”

Potential Benefits of the Business Integration

Nissan and Honda will establish an integration preparation committee to ensure a smooth integration process and conduct focused discussions. Based on the committee’s discussions, as well as detailed examination results, the two companies will consider and analyze more specific combined strengths.

By rapidly realizing combined strengths from the integration, Nissan and Honda aim to become a world-leading company in mobility, with revenue exceeding 3 trillion yen and operating profit of more than 300 billion yen.

The expected benefits from the business integration include:

Scale Advantage through Platform Standardization

Standardizing the vehicle platforms of both companies across multiple product segments is expected to result in stronger products, reduced costs, improved development efficiency, and optimized investment efficiency through standardized production processes.

The integration is anticipated to increase sales volume and operational efficiency, helping to lower development costs per vehicle, including future digital services, while maximizing profits.

Enhancing complementarity within the global product portfolio—including internal combustion engine (ICE), hybrid (HEV), plug-in hybrid (PHEV), and electric vehicles (EV)—will cater to the diverse needs of global customers and improve customer satisfaction.

Enhanced Development Capabilities and Cost Savings through Integrated R&D

According to the MOU signed on August 1 regarding the strategic partnership and joint research on fundamental technologies, the two companies have initiated collaboration on the foundation for SDVs.

Post-integration, they will expand integrated collaboration across the entire range of research and development (R&D) activities, including basic research and applied technologies for vehicles. This will enhance technical expertise, improve development capabilities, and reduce costs through the integration of complementary functions.

Optimization of Production Systems and Facilities

Optimizing production plants and energy service facilities, coupled with improved cooperation through shared production lines, will significantly enhance capacity utilization efficiency and reduce fixed costs.

Strengthened Competitive Advantage in the Supply Chain

Both companies aim to improve competitiveness by enhancing and rationalizing procurement activities, as well as sourcing common supplies from the same supply chain and collaborating with business partners.

Cost Savings through Operational Efficiency Improvements

Integrating systems, operations, and standardizing business processes will lead to significant reductions in operating costs.

Scale Advantage in Sales Finance Functions

Integrating the related sales finance functions of both companies and expanding their scale of operations will provide mobility solutions, including new financial services throughout the vehicle’s lifecycle, to customers of both organizations.

Developing a Talent Platform for AI and Electrification

The human resources of the two companies are invaluable, and building a robust talent platform is essential for the transformation that comes with the business integration. Post-integration, increased employee exchanges and technical collaboration between the companies are expected to further enhance skill development. Moreover, by leveraging each company’s access to talent markets, attracting excellent talent will become more accessible.

Business Integration Method and Stock Listing

Nissan and Honda, after careful consideration, plan to establish a joint-stock company through a stock transfer. This company will serve as the parent company of both enterprises. The implementation of this plan will be subject to approval at the shareholders’ meetings of each company, as well as the necessary approvals from relevant authorities, based on the stable implementation of Nissan’s restructuring measures. Post-integration, both Nissan and Honda will become wholly-owned subsidiaries of the joint-stock company.

Additionally, the two companies will continue to maintain and develop the Nissan and Honda brands equally.

The shares of the newly established joint-stock company are expected to be technically listed on the First Section of the Tokyo Stock Exchange (TSE). The listing is planned for August 2026.

When the joint-stock company is listed, both Nissan and Honda will become wholly-owned subsidiaries of the joint-stock company and will be delisted from the TSE. However, the current shareholders of Nissan and Honda will still be able to trade the shares of the joint-stock company issued during the stock transfer on the TSE.

The listing date of the joint-stock company and the delisting date of Nissan and Honda will be determined according to the rules of the TSE.

Regarding the organizational structure of the joint-stock company, as well as the wholly-owned subsidiaries after the business integration, an optimal structure to realize the combined strengths, including the integration of R&D, procurement, and production functions, will be discussed and considered by the Integration Committee. The goal is to build an efficient, highly competitive organization to operate the post-integration business.

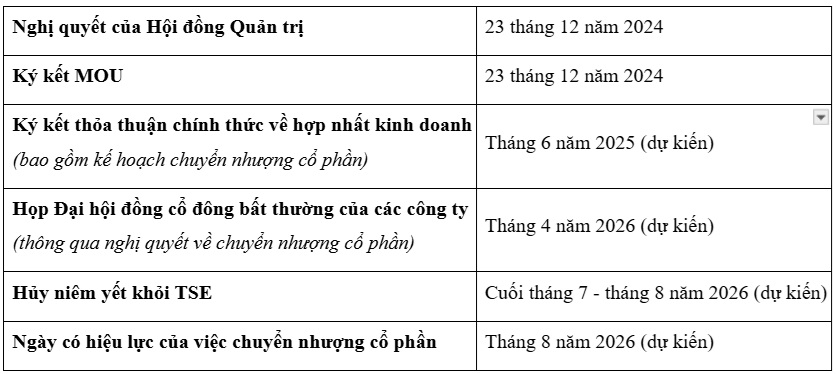

Expected Timeline for the Business Integration

Stock Transfer Ratio

The stock transfer ratio will be determined at the time of signing the final official agreement on the business integration. This determination will be based on the results of a detailed appraisal, third-party assessments, and reference to the average closing price of each company’s stock over a certain period before the MOU announcement.

Management Structure after the Business Integration

At the time the stock transfer takes effect, Honda is expected to nominate a majority of the directors, including both internal and independent directors, in the joint-stock company. The Chairman and Representative Director or the Representative Executive Officer will be selected from the directors nominated by Honda.

Other information about the joint-stock company, such as its name, headquarters location, representative, leadership composition, and organizational structure, will be determined at the time of signing the final official agreement. This decision will be based on the discussions within the Integration Committee, aligned with the objectives of the business integration, and the results of the detailed examination.

TH (Tuoitrethudo)

The Auto Alliance: Honda and Nissan in Potential Merger Talks

According to recent reports, Japanese automotive giants Honda and Nissan are in the preliminary stages of discussing a potential merger. This development has sparked intrigue within the industry, as a union between these two powerhouse brands could significantly reshape the automotive landscape. With Honda’s renowned innovation and Nissan’s global reach, a combined entity would possess formidable capabilities and resources. As the talks progress, the automotive world awaits with bated breath, eager to witness the potential birth of a new titan in the industry.