|

|

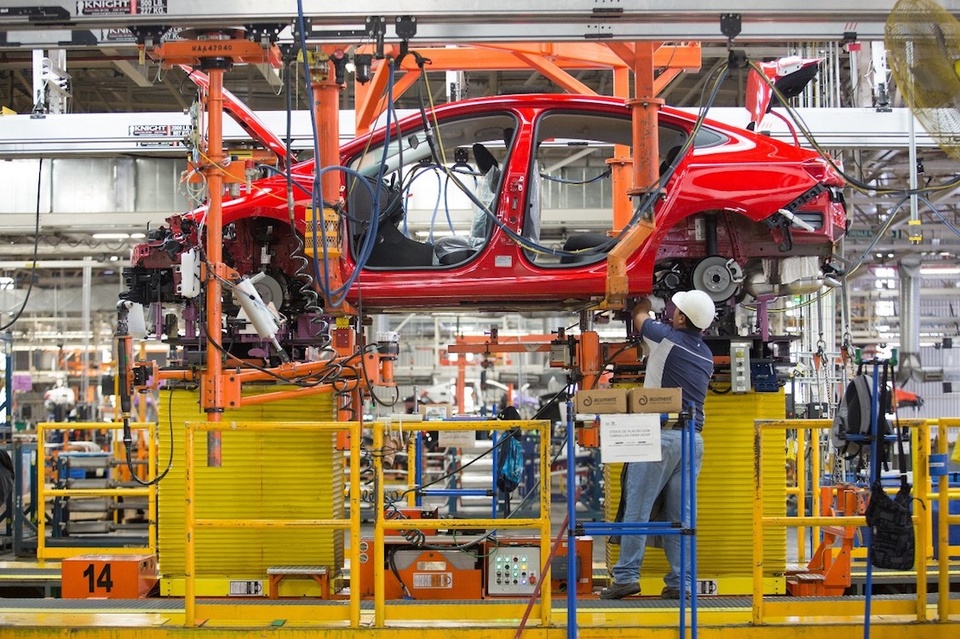

General Motors produced nearly 900,000 vehicles in Mexico last year. Photo: The Detroit Bureau. |

When former President Donald Trump recently announced a plan to impose a 25% tariff on goods from Mexico and Canada, NBC News predicted that the US automotive industry would be one of the most vulnerable sectors.

This perspective is understandable, given that many car brands present in the US are manufacturing vehicles in Mexico and Canada. These two countries are also significant suppliers of auto parts to the US automotive industry.

Mexico – A Fertile Ground for Chinese Cars

Several Chinese car brands have aggressively entered the Mexican automotive market and even become a force that threatens the market share of luxury brands in the country.

Data from Bitcar Chinese Heat Map shows that, during the period from November 2023 to May 2024, the number of Chinese car brands present in Mexico increased by up to 32%.

The expansion of Chinese cars in the Mexican market is believed to be influenced by the open-door policy of the North American country’s government.

Back in 2020, Mexico decided to reduce the import tax on cars from 20% to 0%. This policy aimed to support Mexican citizens in accessing affordable electric vehicles.

| |

|

The zero-import tax policy facilitated the influx of Chinese cars into the Mexican market. Photo: SCMP. |

As a result, the Mexican automotive market quickly embraced a small number of affordable cars from Chinese brands such as Chery, Great Wall Motors, and MG.

From small ripples, Chinese cars have become large waves flooding the Mexican market, quickly capturing a significant market share.

According to Mexico News Daily, China may have completed the export of nearly 500,000 vehicles to Mexico in 2024.

This number is so large that for every three new cars sold in Mexico last year, one was made in China, according to Mexico News Daily. Back in 2020, this ratio was only 4%.

As of now, the Mexican automotive market continues to witness a strong influx of Chinese brands, with BYD, Chery, Geely, and SAIC all establishing dealerships in the country.

| |

|

Interior view of a BYD dealership in Mexico City. Photo: Bloomberg. |

According to The New York Times, advertisements for Chinese automotive brands are constantly appearing on large billboards at airports, stadiums, and streets in Mexico City. Chinese cars, including both gasoline and electric vehicles, are becoming more and more prevalent in the country.

Currently, BYD and several other Chinese car brands are scouting for locations to build manufacturing facilities in Mexico.

BYD is considering building an electric vehicle factory in Mexico, and local media reports that MG will invest $1 billion to establish a production facility in North America.

The initial stated purpose is to serve the Latin American market. However, it is highly likely that the Chinese automakers’ move to build factories in Mexico is aimed at a more ambitious goal – penetrating the US market.

Auto Factories Near the US Border

Mexico is not only fertile ground for Chinese automakers. In reality, General Motors – one of the Big Three of the US automotive industry – is the name that boasts the highest annual vehicle production in Mexico.

Data from MarkLines shows that in 2024, General Motors’ vehicle production in Mexico exceeded 842,000 units. Some of the vehicles produced in this country are even considered the company’s flagship products.

| |

|

The Chevrolet Silverado is one of General Motors’ products manufactured in Mexico. Photo: General Motors. |

For instance, all Chevrolet Equinox and Chevrolet Blazer models that General Motors sells in the US are made in Mexico. The company’s mainstay pickup trucks, such as the Chevrolet Silverado and GMC Sierra, are also assembled in the country that shares a southern border with the US.

Statistics from the National Highway Traffic Safety Administration (NHTSA) show that the Ford Mustang Mach-E, a model assembled in Mexico, uses engines and transmissions made in Mexico. Ford also assembles the Maverick pickup and Bronco Sport SUV in this country.

Mexico is Volkswagen’s chosen location for producing three of its best-selling models in the US: the Jetta, Taos, and Tiguan. According to The New York Times, about 230,000 vehicles that Volkswagen sold in the US last year were of Mexican origin, equivalent to a share of nearly 70%.

According to Mexico News Daily, Mexico exported a total of 2.2 million vehicles to the US in 2023. Mexico was also the top exporter of auto parts to the US last year, with a total value of over $100 billion.

Not as impressive as Mexico, Canada still exported $34 billion worth of auto parts to the US in 2024. This makes Canada another critical link in the US automotive industry and market.

The Canadian market, at this point, remains relatively untouched by Chinese car brands compared to Mexico. However, several car brands present in the US have established some production facilities in Canada, supplying products to the US automotive market.

For example, Stellantis is manufacturing the Chrysler Pacifica MPV at a plant in Windsor, Ontario, Canada.

Toyota is also producing a large portion of its RAV4 models at plants in Woodstock and Cambridge, Ontario, while Lexus SUVs are assembled in the province bordering the US.

As for Honda, the Japanese automaker is manufacturing the Civic and CR-V models at a plant in Alliston, Ontario.

| |